You can use the balance sheet equation, which is assets equals liabilities, plus any stockholders equity. The balance sheet provides a snapshot overview of the firm’s assets, liabilities, and shareholders‘ equity for the reporting period. A common size balance sheet is set up with the same logic as the common size income statement. The balance sheet equation is assets equals liabilities plus stockholders‘ equity. The standard figure used in the analysis of a common size income statement is total sales revenue.

Common Size Balance Sheet Statement

- HBS Online does not use race, gender, ethnicity, or any protected class as criteria for admissions for any HBS Online program.

- One of the best examples of a common size financial statement is to take a look at the sales revenue on an income statement.

- This common size income statement analysis is done on both a vertical and horizontal basis.

- A common size balance sheet allows for the relative percentage of each asset, liability, and equity account to be quickly analyzed.

The common-size strategy from a balance sheet perspective lends insight into a firm’s capital structure and how it compares to its rivals. You can also look to determine an optimal capital structure for a given industry and compare it to the firm being analyzed. You can then conclude whether the debt level is too high, if excess cash is being retained on the balance sheet, or if inventories are growing too high. All three of the primary financial statements can be put into a common-size format.

Common Size and Cash Flow

You can see that long-term debt averages around 34% of total assets over the two-year period, which is reasonable. Cash ranges between 5% and 8.5% of total assets and short-term debt accounts for about 5% of total assets over the two years. Common-size analysis enables us to compare companies on equal ground, and as this analysis shows, Coca-Cola is outperforming PepsiCo in terms of income statement information. However, as you will learn in this chapter, there are many other measures to consider before concluding that Coca-Cola is winning the financial performance battle. When it comes to financial statements, each communicates specific information and is needed in different contexts to understand a company’s financial health.

Key Takeaways

Each financial statement uses a slightly different convention in standardizing figures. This type of analysis is used to analyze a company’s financial statements to identify patterns and trend lines, and to compare a company against competitors. When figures are expressed as a percentage of a whole, analysts can assess how each part contributes relative to another.

A common-size income statement serves a similar purpose to financial ratio analysis. It facilitates like-for-like comparisons across time periods, companies and industries. Despite its limitations, common size analysis is still crucial for understanding how each financial element affects the overall structure of a company. Common-size statements are highly valued because not only do they include the traditional financial data but also offer a more comprehensive look into the health of any firm. A common size statement analysis lists items as a percentage of a common base figure.

A Critical Skill for Business Leaders

A horizontal common-size income statement is a financial statement that compares the percentage change of each item from one period to another. It helps identify the relative importance of different income statement items and highlights company performance changes over time. It makes analysis much easier such that the analyst can see what is actually driving the profit of a company and then compare that performance to its peers. It allows an analyst to look at how the performance has changed over the period. From an investor’s perspective, a common size income statement helps spot patterns in the company’s performance that a basic income statement may not uncover. Common size financial statements reduce all figures to a comparable figure, such as a percentage of sales or assets.

In the future, the company can improve by decreasing investment expenditures and increasing revenue from operating activities. Using Clear Lake Sporting Goods’ current balance sheet, we can see how each line item in its statement is divided by total assets in order to assemble a common-size balance sheet (see Figure 5.22). A common-size balance sheet is a comparative analysis of a company’s performance over a time period. In general, you can prepare a common-size income statement by going line-by-line and dividing each expense as a percentage of sales.

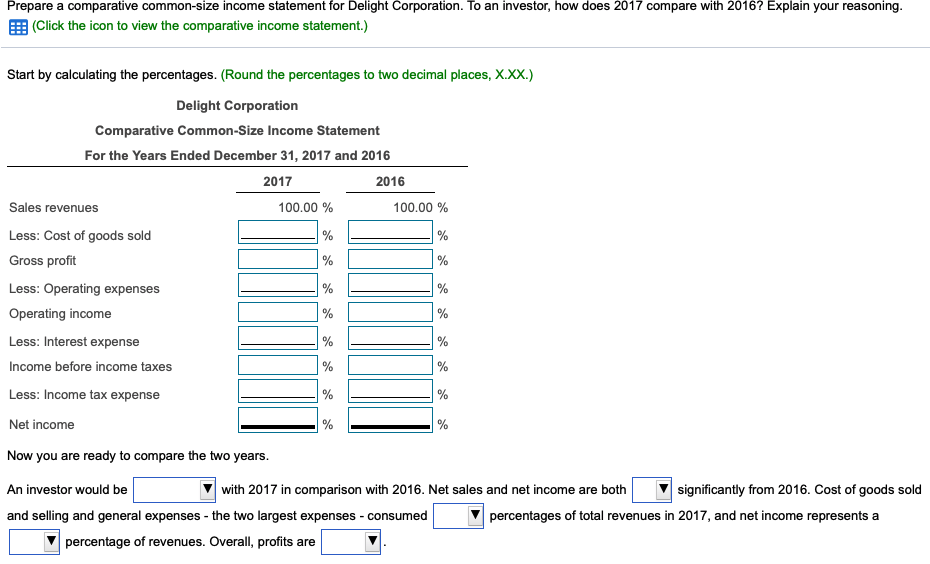

It also includes stockholders equity being listed as a percentage of total stockholders equity. A comparative income statement compares the financial performance of a company over two or more periods, typically showing line-by-line changes in revenue, expenses, and net income. A sample common size income statement helps in comparison of the proportion of various income and expenses within the profit and loss statement for the purpose of financial decision making. It gives valuable insight into the financial health and structure of the business relative to the sales made so that they can take decisions related to expense management, production techniques etc. It facilitates trend analysis and comparison of the financial statement over a period of time.

The steps mentioned above are used to prepare the common size income statement of any business. However, it may bcome a complex process, depending on the size and nature of business operations. The analysis shows that the sample company had a positive accounting basics for an llc influx of cash from operating activities in 2022, but this was overshadowed by a bigger increase in expenditures on investment items. Ultimately, positive cash flow from financing activities left the business with a positive cash position of $13,000.

Liquidity refers to how quickly an asset can be turned into cash without affecting its value. For this reason, the top line of the financial statement would list the cash account with a value of $1 million. Analysts also use vertical analysis of a single financial statement, such as an income statement. Vertical analysis consists of the study of a single financial statement in which each item is expressed as a percentage of a significant total. Vertical analysis is especially helpful in analyzing income statement data such as the percentage of cost of goods sold to sales.

Automating data entry processes and conducting regular audits can help reduce manual data entry errors like duplication and omissions. It’s important to do monthly account reconciliations to maintain data integrity and ensure financial records are accurate and follow the rules. A higher level of net profit margin indicates a higher level of profitability. Note that although we have compared just two years of data for Charlie and Clear Lake, it is more common to use several years of data to get a more robust view of long-term trends. The goodwill level on a balance sheet also helps indicate the extent to which a company has relied on acquisitions for growth. This table shows how each element contributes to the company’s revenue structure, aiding in quick assessments.

Kommentare von fouad